Let the Competition Begin

On April 23, 2024, the Federal Trade Commission (FTC) issued a Final Rule to ban post-employment non-compete agreements. This may have an enormous impact on your business because not only does it ban non-compete agreements into the future, it makes those that are currently in existence unenforceable. Furthermore, it requires that businesses that have such restrictions provide notice to employees that the non-compete agreements are no longer enforceable.

What Is a Non-Compete Clause or Agreement?

The Final Rule affects both standalone agreements or clauses within the agreement. The Final Rule defines a Non-Compete clause as “a term or condition of employment that prohibits a worker from, penalizes a worker for, or functions to prevent a worker from: (i) seeking or accepting work in the United States with a different person where such work would begin after the conclusion of the employment that includes the term or condition; or (ii) operating a business in the United States after the conclusion of the employment that includes the term or condition.”

What Does a Typical Non-Compete Clause Look Like?

They can be found in employment agreements; handbooks; or severance agreements. Typical language may look like this:

Non-Competition. For a period of 1 year following the termination of Employee's employment with Employer (the "Non-Compete Period"), Employee shall not directly or indirectly engage in or prepare to engage in, or be employed by, any business that is engaging in or preparing to engage in any aspect of Employer's Business (as defined below) in any geographic area in which Employer conducted business during Employee’s employment. Employer's Business means the products and/or services offered by Employer during Employee's employment.

What About Independent Contractor Agreements?

The Final Rule affects independent contractor agreements as well.

Are There Any Exceptions?

A few small ones:

- The Ban does not affect non-profit corporations;

- The Ban does not affect non-competition agreements with the sale of a business;

- The Ban allows for existing non-competes to remain for senior executives only. A “Senior Executive” is an employee who makes more than $151,164 annually and who is in a policy-making position;

- The Ban does not apply to restrictions on competition while the employee works for the employer.

When Does the Rule Become Effective?

Based upon the current timeline, August 22, 2024. However, you should expect several lawsuits to be filed and those may delay the effective date.

What Happens if I Don't Comply?

Not only are the non-compete agreements unenforceable, but your business may also be subject to civil penalties. Furthermore, under Nevada Law, if an employer were to seek to enforce an unenforceable non-compete in court, the employer could be responsible for the employee’s attorney’s fees.

Isn't Nevada Law Different?

On paper, yes, Nevada Law does allow for certain non-compete agreements. However, language in the Final Rule states that the Federal law supersedes any state law that is inconsistent.

What Do I Have To Do?

Although the Final Rule is not yet enforceable, and we expect there will be legal challenges to it, employers will be required to provide written note to employees (and former employees) that the non-compete agreement is no longer enforceable. The notice must be provided before the Rule takes effect.

What Does the Notice Have To Say?

- An employer must provide clear and conspicuous notice that identifies the person who entered into the non-compete.

- It must be in digital form or in writing. Oral notice is not effective.

- The only exemption is if the employer does not have a record of street address, email address or mobile telephone number.

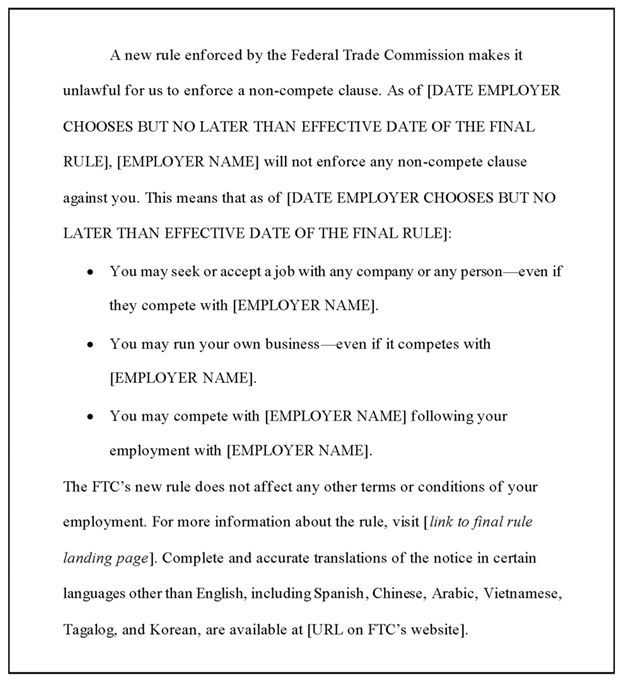

- The FTC has provided model language which, if an employer provides it to current and former employees with non-compete agreements, will provide a safe harbor from penalties. The model language is:

What Should I Do?

- Check all employment related documents you have to determine if you have any non-compete language within them.

- If you have affected employees or former employees, prepare and send the notices.

- Revise all of your employment related documents.

- Revise any independent contractor agreement.

- IMPORTANTLY KNOW THAT THE FINAL RULE DOES NOT AFFECT AGREEMENTS THAT PROTECT TRADE SECRETS; LIMIT SOLICITATION; OR LIMIT DISCLOSURE OF INFORMATION.