Legislative Updates for Planning and Zoning

This article is written by Jamie Thalgott, Francisco Morales-Sánchez and Angela Otto, attorneys at

Brownstein Hyatt Farber Schreck, LLP.

The 2025 Nevada State Regular Legislative Session considered a total of 601 Assembly Bills (“AB”), 508 Senate Bills (“SB”), and 28 joint resolutions, with much of the action occurring during the last week of the session, including a record 87 vetoes by Gov. Joe Lombardo. Highlighted here are a few of the enrolled bills affecting local government zoning and planning, which serve as the gatekeepers to commercial development.

AB241: Directed at expanding housing availability, this bill amends NRS Chapter 278, which governs local planning, to require that no later than March 1, 2026, each governing body adopt an ordinance authorizing by-right a multifamily housing or mixed-use development that includes residential use on property zoned for commercial use; industrial property does not fall within the scope of commercial use. The ordinance may establish the standards for doing this.

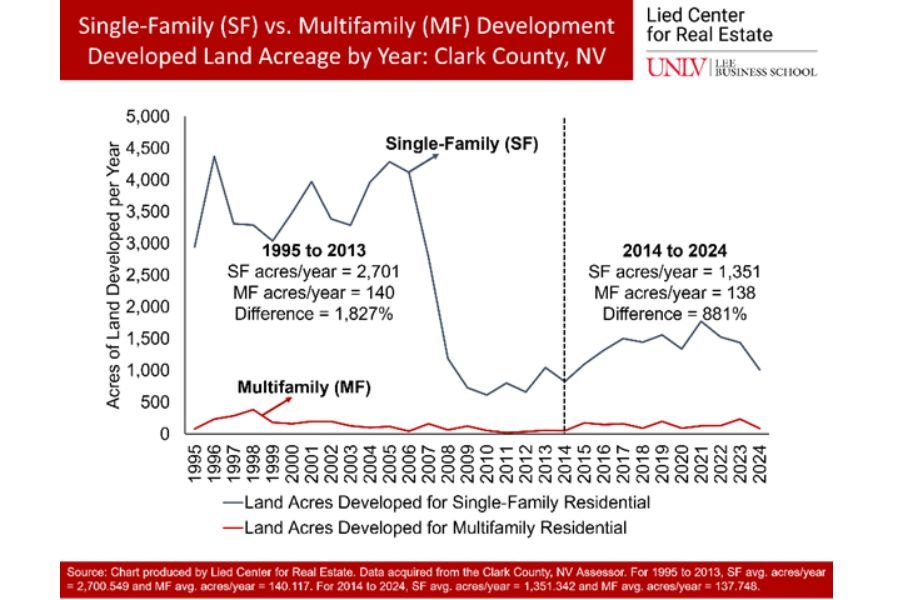

As housing in the valley becomes progressively more unaffordable, this bill hopes to alleviate some of that pressure by increasing the areas allowing multifamily projects, which are traditionally more affordable than single-family residences. Dr. Shawn J. McCoy, director of the Lied Center for Real Estate at the University of Nevada, Las Vegas recently presented to the Board of Clark County Commissioners the following staggering statistics with respect to all vacant land developed for housing in the valley since 2014, which is also illustrated by the graphic below: (1) single-family constitutes 91% of all acres developed to date; (2) single-family development exceeds multifamily by 881%; and (3) in terms of units per acre, single family gets 281% more than multifamily.

Of course, maintaining employment options for Clark County residents is at least as important as maintaining affordable housing levels. Without the opportunity for new commercial enterprises, wages will continue to stagnate, and unemployment levels might too. Implementation of the bill will have to walk the fine line between the two priorities, as opportunities for commercial and economic development feel their own pressures with vacant land, 94% of which is owned by the federal government, becoming scarcer each year.

Dr. McCoy refers to this problem as the wage-rent tradeoff. He noted that UNLV Center for Business and Economic Research forecasts 380,000 people will move here in the next 10 years (a number bigger than the current populations of City of Henderson and North Las Vegas). Population growth can drive rent up and wages down as more people need two things—places to live and places to work. Further impacting the issue, we can’t always build certain commercial asset classes on infill parcels (for example, you don’t see high-rise industrial buildings). The land itself, in terms of size, slope and adjacency, dictates what type of asset classes support it. Preserving critical pieces for commercial development will be paramount as our local governments navigate this important issue.

SB28: Championed by the City of Las Vegas, this bill encourages development of public transportation near housing developments. It will allow developers proposing projects that align with a municipality’s goals for affordability or transit-oriented development (TOD) to partner with local governments to use tax increment financing to fund necessary public infrastructure, such as new roads, utility upgrades or transit stops. This can significantly reduce a developer’s off-site improvement costs, making large-scale, master-planned and mixed-use projects more financially feasible.

WithBrightline breaking ground on its new high-speed rail, and reports of The Boring Company buying up properties along its transit tunnel system, theLas Vegas Loop, we are starting to see the framework put in place for these types of developments. With construction costs high and volatile, having local government as a partner on issues of infrastructure will be paramount. Although the session saw some broader economic development bills fail, in the theme of supporting housing and affordability, this bill moved forward.

SB72: This bill amends the Henderson City Charter, such that the city may now sell any real property (not just unimproved real property) on a time payment basis. It also removes the requirement that the city accept at least its cost of acquisition as consideration for the transfer of real property once owned by the state, Clark County, the federal government or any other quasi-public or nonprofit entity. Presumably, this will make land sales easier and more efficient as the county continues to face vacant land shortages, because municipal-owned land sales have historically been a tool for economic development (e.g., the Raiders headquarters).

AB211: This bill empowers local governments, tenants and tenant advocacy groups to file a civil action in district court against the owner of a residential multifamily property that is maintained in a “substandard” condition, which includes violations of habitability standards or building codes. Most critically, the court is authorized to appoint a receiver to take temporary control of the property, manage repairs using rents, and even borrow money to complete the work, with the owner ultimately responsible for all costs.

While the foregoing does not include every piece of legislation affecting local governments, it provides an insight into the types of issues confronted by the state and what our legislature deems important. Please contact a member of our team to answer any questions related to the 2025 legislative session and to help navigate any new opportunities or challenges raised thereby.