WELCOME TO the

HENDERSON

CHAMBER OF COMMERCE

Personal Relationships. Powerful Results.

HENDERSON CHAMBER OF COMMERCE

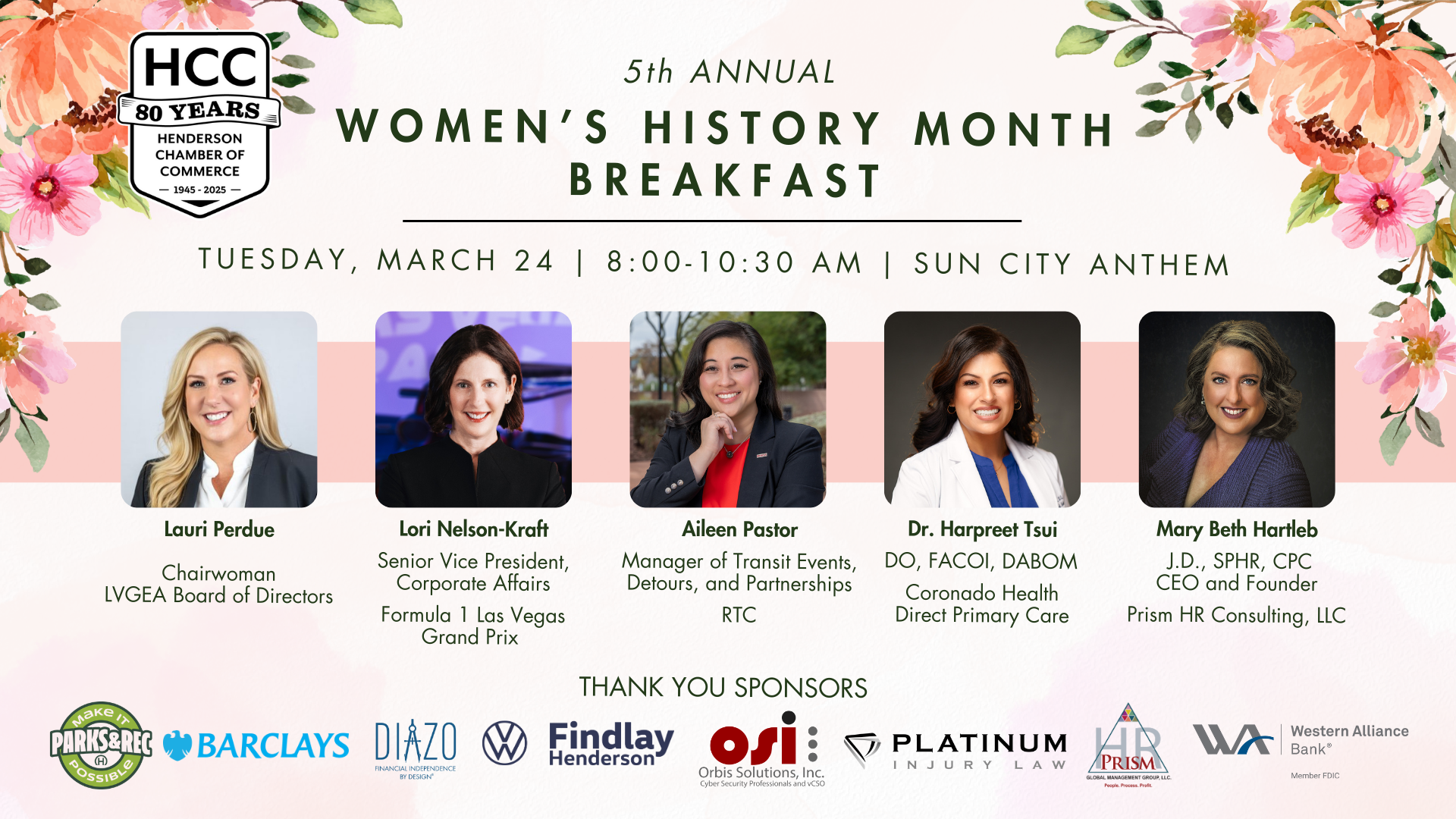

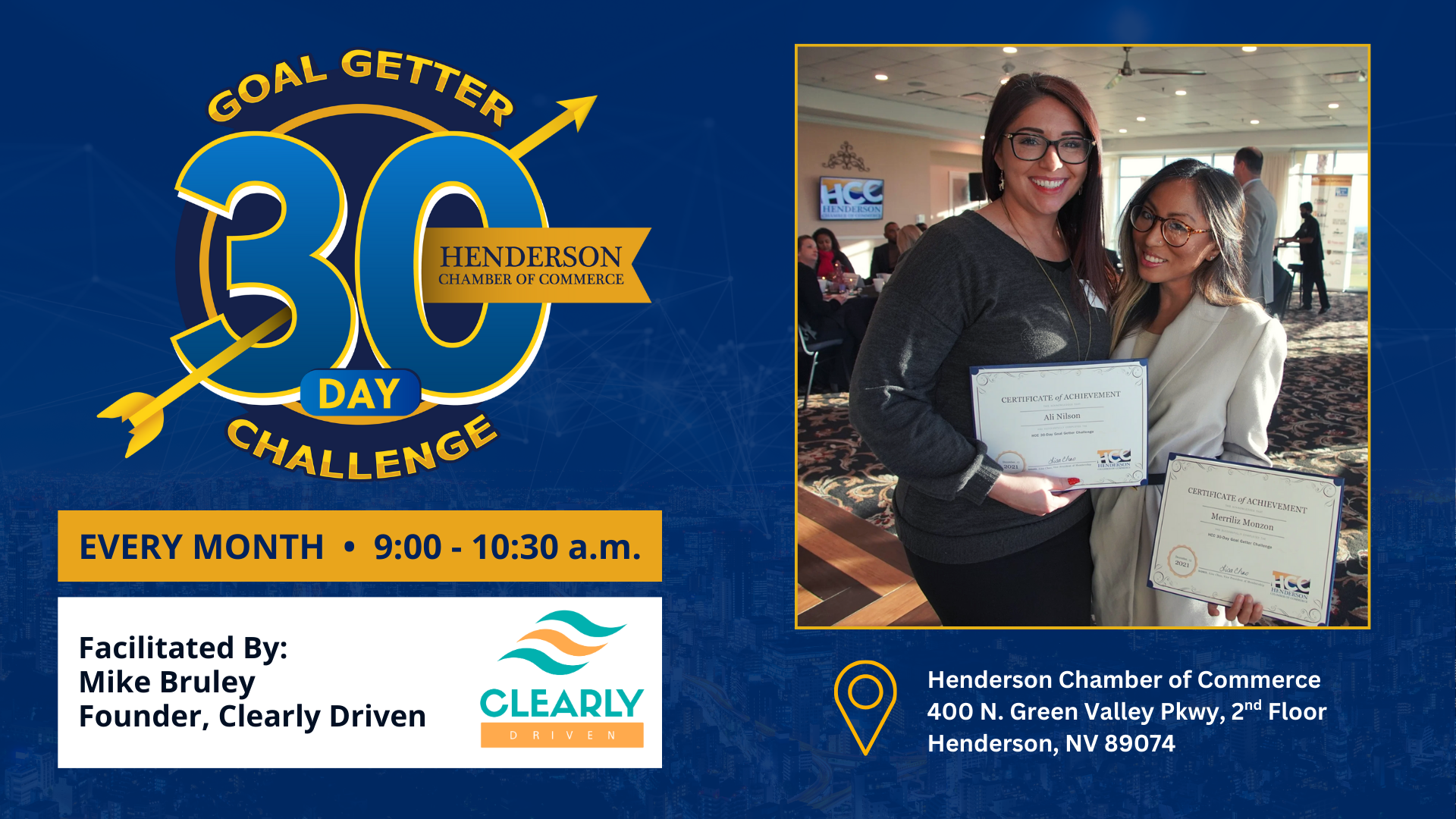

Key Events

&

Highlights

View our full calendar of events and submit your event below!

Latest News & Updates

The holidays are all about giving, joy, and creating unforgettable memories and Tivoli Village is the perfect place to do just that! This December, we’re thrilled to host two incredible events that bring our community together in the spirit of generosity and celebration: Toys for Tots. Mark your calendars and join us for these heartwarming experiences! On Friday, December 12, from 4:30 PM to 7:00 PM, Gunny Bear is all “wrapped up” in the holiday spirit, and we invite you to join him in spreading hope and joy to children in need. This magical evening will be filled with festive fun, including live music to set the holiday mood, photos with Santa for the perfect seasonal keepsake, and a chance to meet the UNLV Rebel Hockey Team along with members of the Marine Corps. Bring a new, unwrapped toy to donate and help light up the holidays for families in need. As a thank-you for your generosity, you’ll receive $5 off a UNLV Rebel Hockey ticket, a little extra cheer for your holiday season! Don’t miss this opportunity to give back while enjoying music, community, and the magic of the holidays at Tivoli Village. Tivoli Village is a captivating blend of European elegance and contemporary lifestyle, where every moment becomes a celebration. From dancing in the streets with loved ones to exclusive events in The Piazza with friends and family, we curate an unrivaled experience. Discover our carefully selected retailers, ranging from luxurious brands to one-of-a-kind boutiques, anchored by Restoration Hardware’s RH Las Vegas. Indulge yourself in enticing restaurants for a girls’ night out at Echo & Rig Butcher and Steakhouse, savor late-night drinks and cigars with the boys at La Casa, or work out at Tivoli Village’s exclusive upscale members-only gym, Kilo Club. For more information, visit https://tivolivillagelv.com or follow along on Instagram and Facebook.

Upcoming Chamber Events

Contact Us

Advertising Tools

Which HCC Communication Tool Works Best for

Your Company’s Marketing Needs and Budget?